Get the free lineal relative transfer form

Show details

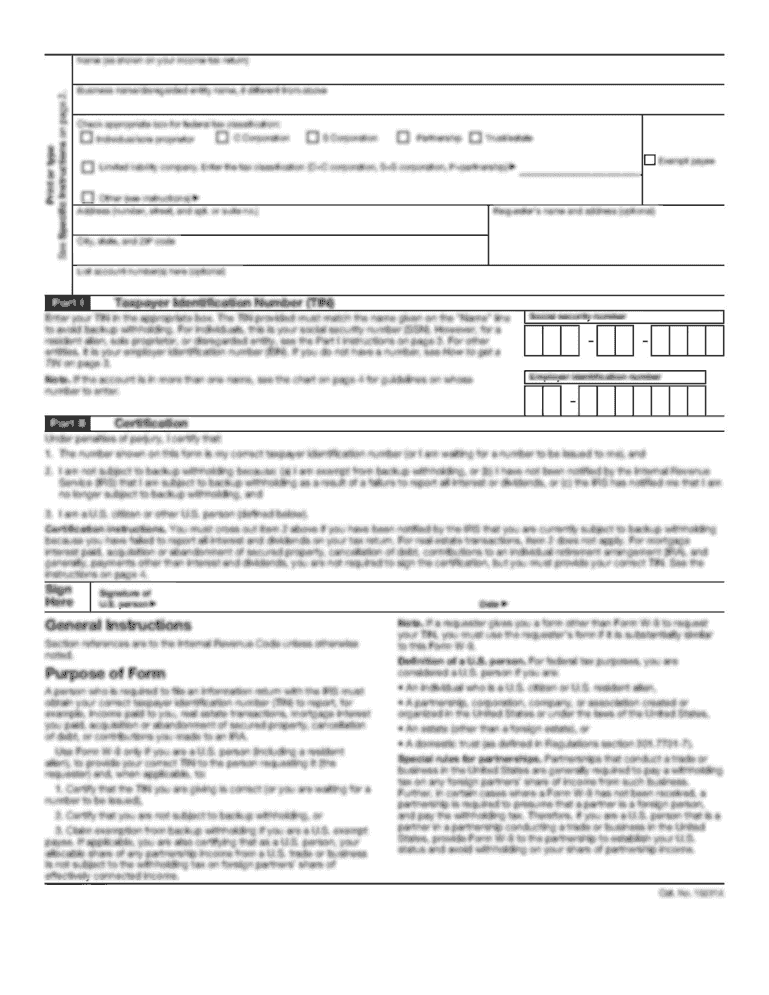

Tennessee Department of Revenue AFFIDAVIT OF NON -DEALER TRANSFERS OF MOTOR VEHICLES AND BOATS Lineal relative transfer (Persons qualified when related to transfer as: spouse, sibling, child, grandchild,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lineal relative transfer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lineal relative transfer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

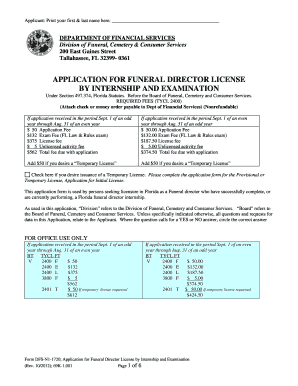

How to edit lineal relative transfer form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lineal relative transfer form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out lineal relative transfer form

How to fill out a lineal relative transfer form:

01

Gather all necessary information about the lineal relative you are transferring. This includes their full name, date of birth, and relationship to you.

02

Fill out the personal details section of the form with your own information, including your full name, contact information, and relationship to the lineal relative.

03

Provide any additional supporting documentation required, such as proof of relationship or legal documentation.

04

Complete the transfer details section, including the reason for the transfer and any specific instructions or conditions.

05

Review the form carefully to ensure all information is accurate and complete.

06

Sign and date the form.

07

Submit the form according to the instructions provided, whether it is mailing it to a specific address or submitting it online.

Who needs a lineal relative transfer form:

01

Individuals who wish to transfer ownership or certain rights to a lineal relative.

02

People who need to legally document the transfer of assets, property, or responsibilities to their lineal relative.

03

Those who want to ensure that their lineal relative is properly recognized and protected in official records and documentation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lineal relative transfer form?

There does not appear to be a specific "lineal relative transfer form" that is widely recognized or commonly used. Without further context or information, it is difficult to provide a precise answer. However, a lineal relative transfer form could potentially refer to a legal document or process used for the transfer of certain rights, assets, or obligations between family members who are directly related in a direct line of descent, such as between parents and children or grandparents and grandchildren. It is advisable to consult with a legal professional or relevant authority for clarification and guidance on any specific forms or procedures related to lineal relative transfers.

Who is required to file lineal relative transfer form?

It is typically the executor, administrator, or personal representative of an estate who is required to file a lineal relative transfer form. This form is used to transfer ownership of real property to the decedent's lineal relatives (such as children or grandchildren) without the need for probate.

How to fill out lineal relative transfer form?

To accurately fill out a lineal relative transfer form, you can follow these steps:

1. Obtain the form: Contact the relevant organization, such as a bank or government agency, and request the lineal relative transfer form. They may provide an online version that you can download or a physical copy that you can pick up.

2. Read the instructions: Carefully review the instructions provided with the form. This will help you understand the purpose of the form, what information is required, and any special considerations.

3. Gather necessary information: Collect all the information required to complete the form. This may include the names, addresses, and contact details of both the transferor (person making the transfer) and the transferee (lineal relative receiving the transfer). Make sure you have any additional supporting documents that may be needed, such as proof of relationship or identification.

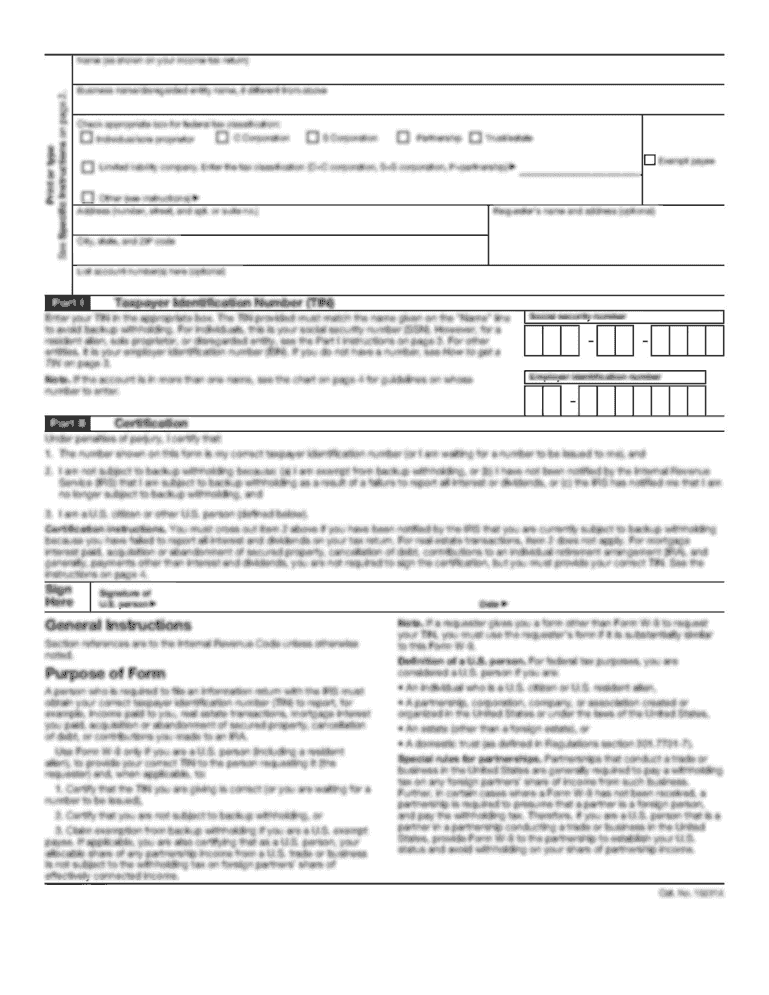

4. Fill in personal details: Start by filling in the personal details of both the transferor and transferee. Provide accurate and up-to-date information, including full names, dates of birth, Social Security numbers, and addresses.

5. Indicate relationship: Specify the relationship between the transferor and transferee. In this case, as it's a lineal relative transfer form, you'll need to indicate the familial relationship, such as parent-child, grandparent-grandchild, or great-grandparent-great-grandchild.

6. Complete transfer details: Provide all the necessary information related to the transfer itself. This may include the type of asset or funds being transferred, the current value, and any other relevant details. If there are multiple assets or funds being transferred, ensure you provide information for each one separately.

7. Include any additional documentation: If the form requires specific supporting documents, make sure to attach them securely. This could include birth certificates, marriage certificates, or any other proof of relationship required.

8. Review and sign: Before submitting the form, carefully review all the information you've provided. Check for any errors or omissions and make corrections if necessary. Once you are satisfied with the accuracy of the form, sign and date it as required.

9. Submit the form: Follow the instructions provided to submit the form. This may involve sending it via mail, delivering it in person, or submitting it through an online portal. Keep copies of the completed form and any supporting documents for your records.

Remember to consult the specific instructions provided with the lineal relative transfer form you are using, as requirements may vary depending on the organization or jurisdiction.

What is the purpose of lineal relative transfer form?

The purpose of a lineal relative transfer form is to transfer ownership or assets from one lineal relative (such as a parent to a child or vice versa) to another. This form is often used when transferring property, bank accounts, or other assets between family members without the need for a formal sale or purchase. It helps to establish the legal transfer of ownership and ensures that the transaction is recorded appropriately.

What information must be reported on lineal relative transfer form?

The exact information required on a lineal relative transfer form may vary depending on the specific country or organization that is receiving the form. However, some common information that is typically included in such forms includes:

1. Full names and contact information of both the transferor (the person making the transfer) and the transferee (the person receiving the transfer).

2. Relationship between the transferor and transferee (e.g., parent-child, grandparent-grandchild, etc.).

3. Description of the assets or property being transferred (e.g., real estate, financial assets, personal belongings).

4. Estimated value of the assets being transferred.

5. Date and location of the transfer.

6. Any applicable bank or financial institution details for the transfer of financial assets.

7. Signatures of both the transferor and transferee, along with any witnesses if required.

It is important to note that this is just a general guideline, and the specific requirements for a lineal relative transfer form may vary based on the governing laws and regulations of the jurisdiction in question.

How can I send lineal relative transfer form for eSignature?

When your lineal relative transfer form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit lineal relative transfer form on an iOS device?

Create, modify, and share lineal relative transfer form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit lineal relative transfer form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like lineal relative transfer form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your lineal relative transfer form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.